Announcing Tiger Testnet: Preparing For Catalyst Mainnet

Catalyst: Tiger Testnet is now LIVE! Explore the final testnet for Catalyst on Optimism, Arbitrum, and Ethereum Sepolia.

Hello, Catalyst Community! Riding the wave of the unprecedented success of Lynx Testnet, we have been working tirelessly to continue levelling up the protocol.

Today, we're thrilled to launch Tiger Testnet, the final version of the Catalyst testnet before mainnet launch (soonTM) – packed with brand-new features and brand-new chain support.

Tiger Testnet will have feature parity with Catalyst Mainnet, serving as the last opportunity the community will have to use Catalyst in a testnet capacity before full launch of the protocol.

In celebration, Catalyst is extending its support to embrace three new testnet networks: Optimism (OP Sepolia), Arbitrum Sepolia, and Ethereum Sepolia. Tiger Testnet brings us closer to our ultimate goal of interconnecting all chains under the Catalyst interoperability umbrella.

You can get started today by either going to the Catalyst UI and completing tasks that walk users through the main highlights of the brand new testnet.

Tiger Testnet’s new features

Lynx Testnet unveiled the full might of Catalyst, and Tiger Testnet supercharges the Catalyst Protocol to make it the obvious choice for permissionless cross-chain swaps.

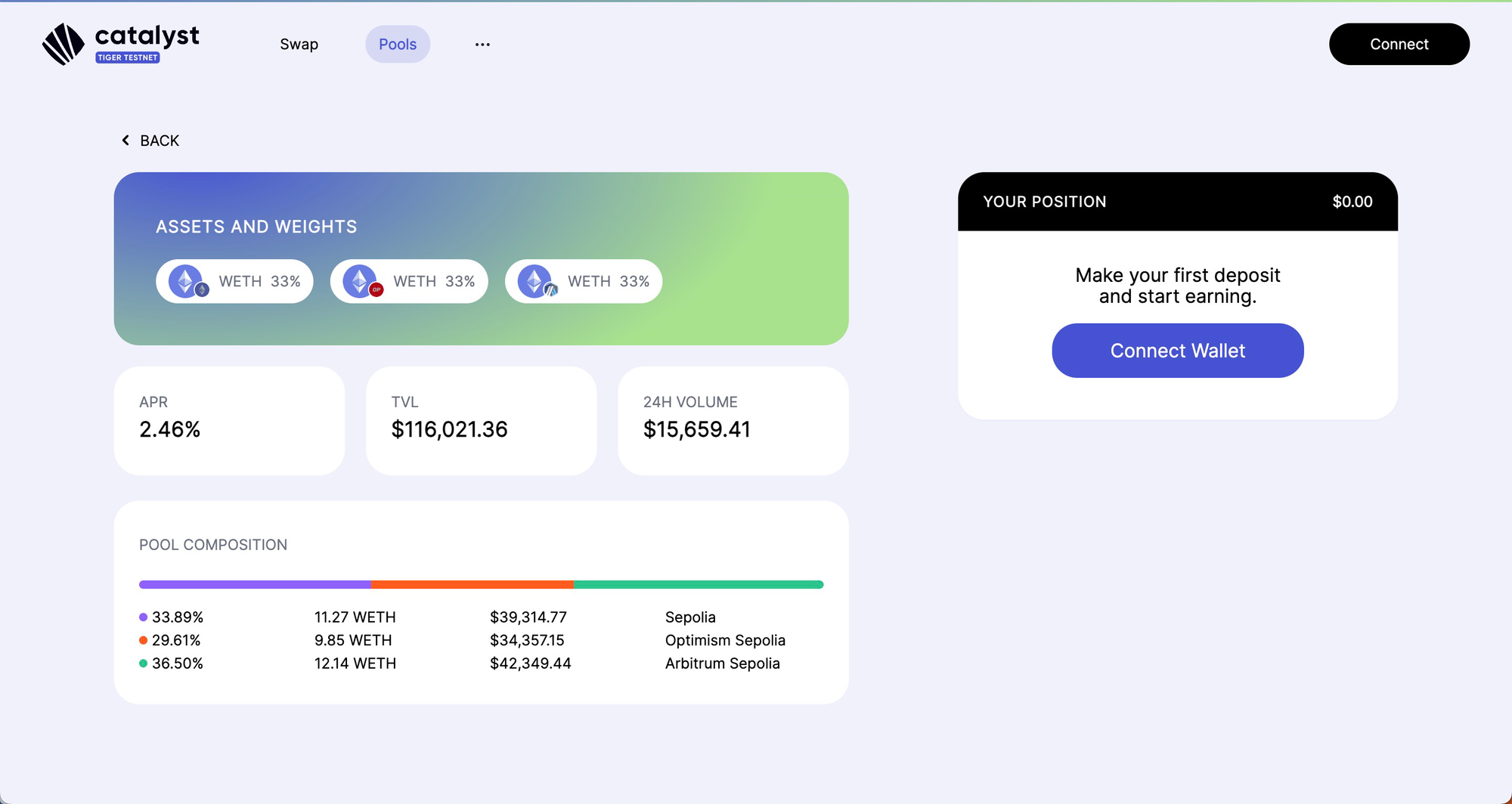

Multi-chain pools

For the first time in history, we have pools that span across multiple (3+) chains! Like a cross-chain Balancer, Catalyst can now support multi-asset pools across three or more chains.

Starting off, we've initialised a pool to connect WETH across the Ethereum, Optimism and Arbitrum networks for cross-chain swaps. That means you can now swap native WETH on all three chains in a capital-efficient way!

And this is just the beginning – in the near future, you'll have the freedom to connect any existing or new chain to these assets and networks. This integration is just the initial step towards welcoming more chains into these networks, fulfilling our vision of a Borderless Blockchain.

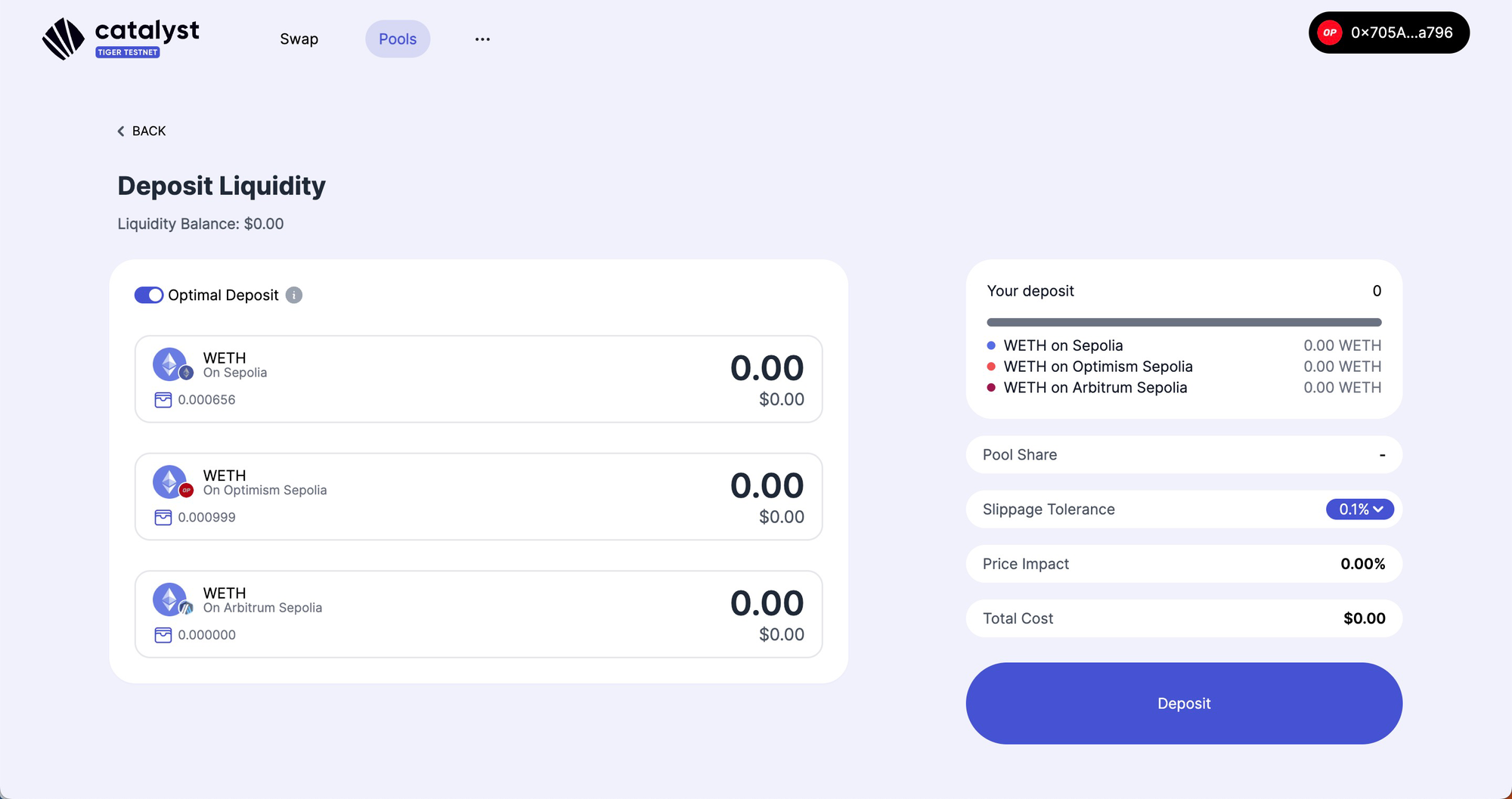

Deposit and withdraw

The long awaited feature. With Tiger Testnet, you can now explore Catalyst’s cross-chain pools, optimise cross-chain deposits into them, and earn yield from the pool’s cross-chain volume.

With pools now at your fingertips, depositing assets into different networks has never been more seamless. Here’s how it works:

- Navigate to the pool you’re interested in adding liquidity to.

- Input the amount of assets you wish to provide on each respective network.

- Quickly review the key details on the right hand side, including slippage, price impact, and total cost of the deposit.

- Confirm your action on your wallet to initiate the deposit.

Tiger Testnet will start off with equal deposits (i.e., depositing equal amounts for each chain), but in the near future, you’ll be able to add uneven amounts – even a single token if you’re just beginning to dive into a new network’s ecosystem – making it a much easier UX to navigate cross-chain pools via Catalyst.

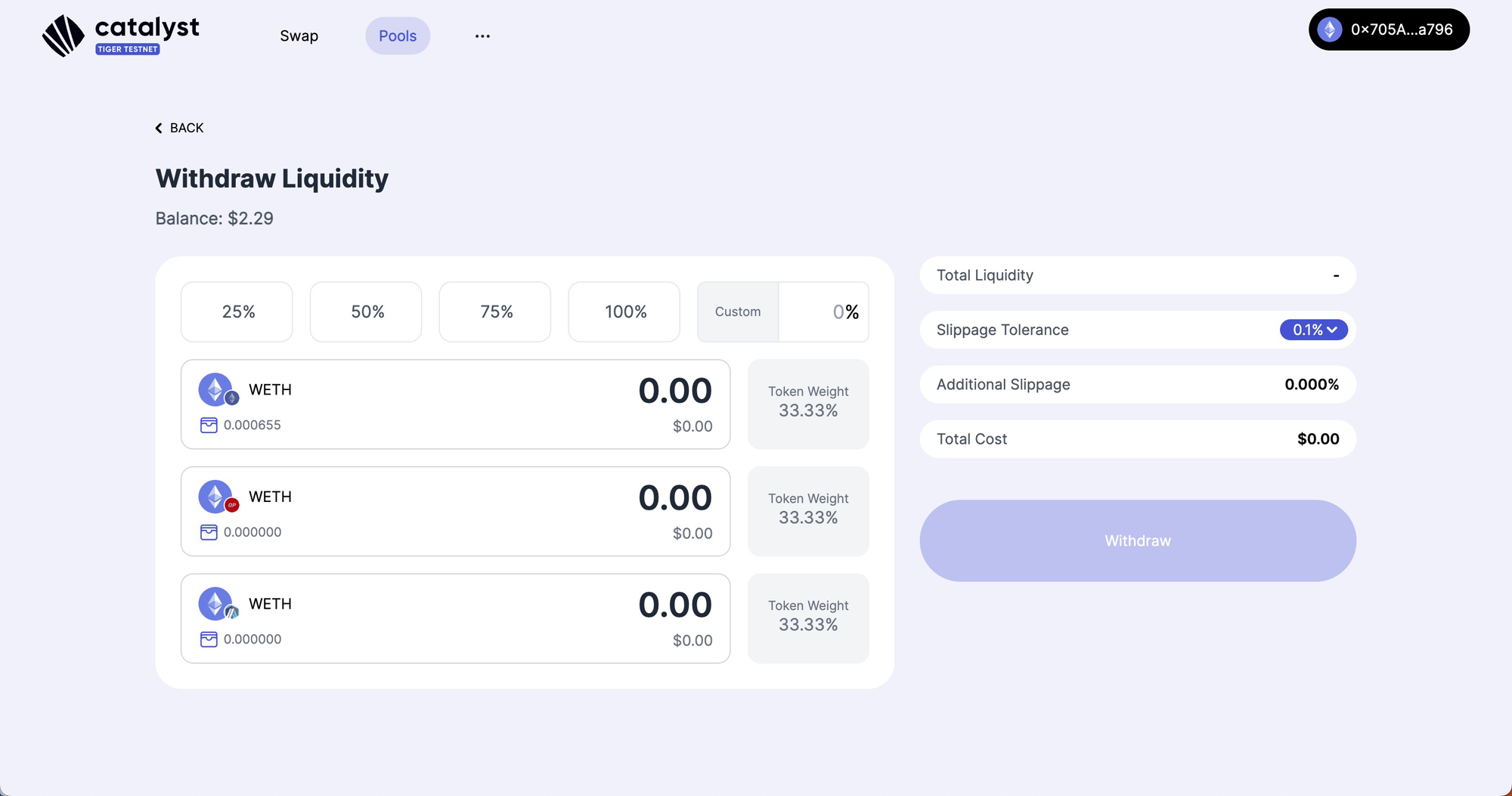

Withdraws work the same way but in reverse. Head over to the pool page, choose the pool you’d like to withdraw from, input the distribution of assets that you want to withdraw, and keep in mind that an uneven withdrawal might incur additional price impact (which is highlighted on the right hand side of the screen).

Instant liquidity

With Tiger Testnet, Catalyst now employs solvers (technically known as Underwriters) in order to provide instant cross-chain liquidity for users.

What this translates to for users is that they will receive instant liquidity for their cross-chain swaps, instead of waiting a few minutes for the participating chains to include their transactions into a block and finalise it.

Catalyst was built with the end-user in mind. We understand that speed is paramount in the world of DeFi and cross-chain transactions. Currently, cross-chain swaps take several minutes to complete, bound by the inherent time-to-finality of the underlying blockchains. However, by offering a dynamic overlay of additional counterparties (i.e., the solvers), Catalyst breaks this mould and drastically reduces swap time to a few seconds.

When a user initiates a transaction on the source chain, solvers are made aware of this intent. They can choose to fulfil the transaction by fronting liquidity for users from their own inventory on the destination chain. In a few minutes, the solvers will be “reimbursed” the liquidity from the normal Catalyst transaction via its cross-chain pools – but only after Catalyst scrutinises and confirms whether the user actually received the funds from the solver.

The differentiating of this mechanism compared to other solver models lies in its ability to accelerate user transactions without compromising on security. The underlying security of the Catalyst cross-chain message (via the arbitrary messaging bridges) remains intact, so Catalyst pools are not exposed to any risk. If a solver faces technical glitches, goes offline, or decides to withhold a transaction, the transaction will seamlessly revert to a standard Catalyst swap which finalises in a few minutes.

Relayer incentives via GARP

A few weeks ago, we unveiled Generalised Automatic Relayer Payments (GARP), a general incentives framework for cross-chain relayers, created by the Cata Labs team and open-sourced for the broader interoperability community to freely use. Since then, GARP has been integrated by Wormhole and Polymer for any of the chains that they connect.

With GARP, relayers can be comprehensively compensated for delivering packets across chains–accounting for detailed and nuanced expressivity such as one-off deliveries, round-trip packet transfers, compensation of gas on destination, and timeliness of deliveries.

GARP opens the door for cross-chain applications to gain access to permissionless relaying, trust-minimised relaying, as well as faster packet delivery. What this translates to in practice is that end-users will receive faster cross-chain transactions!

Lynx Testnet had been running on a set of permissioned relayers, but now with GARP, Tiger Testnet will have permissionless relaying of its cross-chain transactions. As a result, Tiger Testnet is now more distributed and censorship-resistant than previous versions of Catalyst.

We’ve open-sourced the Catalyst relayer implementation, which you can check out here. If you are keen to run your own relayer, join us on Discord under the #relayer-support channel.

Exploring Ethereum, Optimism, and Arbitrum

Ethereum, the trailblazing and leading decentralised platform for financial transactions and revolutionary applications, needs no introduction. It’s a blockchain known around the globe, powering smart contracts and paving the way for decentralised innovation.

Optimism is an Ethereum L2 scaling solution that uses optimistic rollups. It bundles transactions into a single transaction on Layer 1. OP Mainnet, a Layer 2 Optimistic Rollup network, combines Ethereum's security with reduced cost and latency. Fast, stable, and built for Ethereum developers, OP Mainnet's EVM-equivalent architecture scales apps without surprises.

Arbitrum offers Ethereum scalability, performing all Ethereum tasks at lower costs and faster speeds. The flagship, Arbitrum Rollup, is an optimistic rollup with Ethereum-level security, ensuring secure scaling with Ethereum. With high-throughput, low-cost smart contracts and advanced proving technology, Arbitrum scales Ethereum smartly.

Buckle up as we embark on an exhilarating journey through the Ethereum, Optimism, Arbitrum Testnets via Tiger Testnet. Whether you're eager to dive into seamless swaps or explore opportunities for competitive yield generation (via LPing), Catalyst is your gateway to a cross-chain realm brimming with possibilities.

How to get started

Are you ready to navigate the landscape of the Tiger Testnet? Don't worry about resources – each chain, including Ethereum, Optimism and Arbitrum, has its own dedicated faucet, ready to provide you with the essentials. This ensures your journey through the Catalyst: Tiger Testnet is smooth and seamless. Claim your testnet funds in our how-to guide..

The launch of Tiger Testnet–coupled with Catalyst’s integration with Ethereum, Optimism and Arbitrum testnets–means that we’re one step closer to the future of seamless cross-chain connectivity.

Stay engaged with us, follow our social channels, and actively participate in discussions there. By being part of this exciting evolution, you'll be at the forefront of Catalyst's expansion into a brand-new world of interoperability.

About Cata Labs

Cata Labs is a software development company that contributes to open-source technology, including Catalyst Protocol. Cata Labs is backed by prominent investors such as Spartan Group, HashKey, Polygon and Circle.

Catalyst Protocol is an AMM purpose-built to connect all chains. Its mission is to empower individuals to acquire any asset on any chain. Using Catalyst, any chain can swap assets with major blockchains like Cosmos, Ethereum and its rollups. Catalyst Protocol is operated by Catalyst Foundation, based in the Cayman Islands. Find out more about the Catalyst Foundation at its Twitter.